Have you heard the term “New Market Tax Credit”? This program was established by Congress in 2000 as a federal initiative aimed at stimulating investments in low-income and economically distressed communities. By offering tax incentives to investor corporations, the NMTC program encourages private investments in businesses and real estate projects within underserved communities in the United States.

Objectives of the NMTC Program

The main goal of the new market tax credit program is to provide jobs to low-income communities or underserved communities with services that they are lacking in the area, such as grocery stores or healthcare services, or to provide a significant infusion of jobs.

The NMTC program seeks to address these issues by:

- Attracting Private Investments: By providing tax credits to investor corporations, the program makes it more appealing for investors to direct their resources into these underserved areas.

- The areas included in the program can be blighted urban areas, but it also includes rural areas that may lack jobs, or minority communities like Native American reservations.

- Promoting Economic Development: Investments facilitated by the NMTC program support the development of businesses, commercial real estate, and community facilities, which in turn create jobs and foster economic growth.

- The most funded projects are industrial projects or industries that provide jobs to the local residents.

How the NMTC Program Works

The basis of the program is an Allocation of Tax Credits, which is administered by the US Treasury.

- CDFI Fund: Administered by the US Department of the Treasury, the Community Developments Financial Institutions (CDFI) Fund awards NMTC allocation authority to Community Development Entities (CDEs) through a very competitive application process. These allocations are granted based on the CDE’s track record, community impact, and capacity to leverage private investment.

- The tax credit funding is based on what Congress has allotted each year. For the 2023/2024 funding round, a total of 948 organizations applied for $14.8 billion in funding, while the allotment was about 1/3 of that at $5 billion. The competitive nature of this funding makes sure that the resources are going to the projects that will stimulate the most community growth or benefit.

- The 2024/2025 funding round has $10 billion allotted to it.

- CDEs: A CDE is a domestic corporation or partnership that serves as an intermediary between investors and low-income communities. To receive NMTC allocations, a CDE must demonstrate a primary mission of serving or providing investment capital for low-income communities or individuals.

- Low-Income Communities: Investments by CDEs must be made in low-income communities or areas otherwise designated as in need of investments – like Brownfields, FEMA disaster zones, state Enterprise zones, and areas lacking food or medical resources.

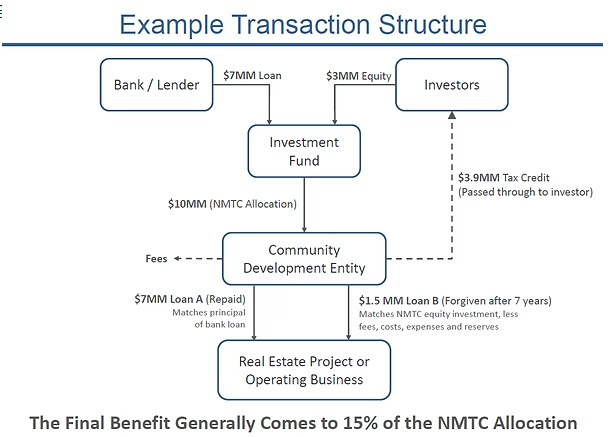

- Investor Contribution: Investors, typically banks or large financial institutions, provide capital to CDEs in exchange for NMTCs. These investments can be in the form of equity investments or loans.

- Deployment of Capital: CDEs use the capital raised to finance qualified low-income community investments (QLICIs), which can include loans or equity investments in businesses and real estate projects within the targeted low-income areas.

- Receipt of Tax Credits: Investors receive tax credits over a seven-year period, totaling 39% of the initial investment amount. The credits are distributed as follows: 5% annually for the first three years, and 6% annually for the remaining four years.

- Example: An investor (typically a bank) makes a $10,000,000 investment into the CDE. $3,000,000 of this investment can be equity, and the other $7,000,000 is debt. The investor bank receives back 39% of the $10M investment as tax credits, which is $3,900,000. The investor bank also receives interest on the debt portion of $7M.

NMTC Dos and Don’ts

DO: Note that it is the intent of New Market Tax Credits to stimulate growth in the communities they serve and, as such, focus on commercial ventures

- Development of for-sale housing is permitted

- Mixed-use development is permitted if 20% of more of the gross income is allocated to the commercial portion

- Ground-up or new construction retail, industrial, healthcare, and mixed-use use is permitted

DON’T: These property types are not permitted

- Rental of real estate where no substantial improvements are being made

- Rental housing where the residential portion exceeds 80%

- Sin businesses

How Investors Can Benefit

- By borrowing from the CDE: For a qualifying investment in a low-income community, the investor can access funds that are below market rate development costs for their project. Loans are usually interest-only for seven years, making them easily affordable for the stabilization period.

- At the end of the seven-year period, the tax credit for the equity investor will have been depleted, and that investor will usually exit for a nominal value with the borrower simply assuming the debt provided by the NMTC. This provides an advantageous way for both parties to exit the transaction.

- The deal size minimum is typically $5 million or greater.

- Accessing funds otherwise not available: Using these funds as part of their “capital stack” allows investors to fund projects that otherwise would not be able to be financed or would be highly restricted in LTVs.

- Funding provided by NMTC can help to fill a gap where other financing would not go.

- A local entity, Community First Fund, has an approved CDE that provides access to the capital based on the credit awards that they have received.

- There are many types of CDEs that focus on different “missions”. Some deploy their resources focused solely on providing services to a community, while others may be focused on providing jobs in rural communities, or focused on the development of for-sale housing. The type of project you plan to pursue will direct you to the CDE focused in that area.

- Note that NMTC allocations are made to the CDE based on their intended use and mission, and are not project-specific. This is different than Low Income Housing Tax Credits, which are project-specific.

Conclusion

The New Market Tax Credit program represents a powerful financing tool for bringing investments and economic developments in America’s most low-income communities. By offering tax incentives to corporations to bring in investments, this program provides vital funding for community needs, which brings a higher standard of living to all of the residents in the community.

Many investors we work with have benefitted from our knowledge of various paths and opportunities for real estate investments. Call us for a consultation to grow your returns through creative solutions.

Videos

Prefer to watch rather than read? Naomi made a video just for you!

Sources

https://www.cdfifund.gov/programs-training/programs/new-markets-tax-credit

https://communityfirstfund.org/financing/new-markets-tax-credits/