For real estate investors who continue to do value add construction projects or new developments, they know that the increased cost of construction makes it very challenging to make projects pencil.

For those investors seeking to enhance returns and find ways to make a project provide reasonable returns, the LERTA program can significantly help to boost NOI by providing an abatement of property tax over a period of time.

As most investors have experienced, when significant improvements are made to a building involved permits and revitalization, there may be a property tax increase because the assessed value will increase.

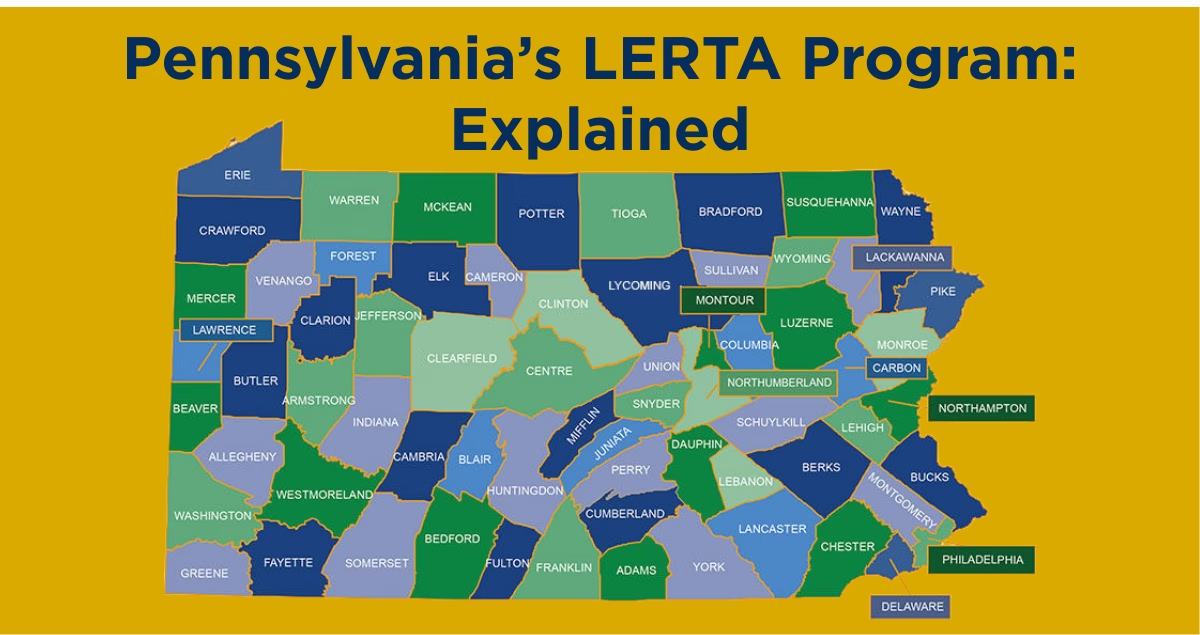

The LERTA program, short for Local Economic Revitalization Tax Assistance Program, when approved through local government through varying processes, can provide the abatement or gradual ‘phasing in’ of property taxes, which increase the investment return of the property during that time. Designed to stimulate redevelopment and attract investment in economically distressed areas, LERTA offers temporary property tax abatements for eligible improvements to real estate.

What Is LERTA?

LERTA is a tax incentive program created under Pennsylvania Act 76 of 1977, allowing local taxing authorities—counties, municipalities, and school districts—to offer property tax abatements on the increased assessment value of a property due to improvements. This means that while you will continue paying taxes on the original value of the property, the new value added through renovations or new construction may be exempted from taxes for a defined period.

- The exact terms of the abatement (e.g., duration, percentage of exemption) vary by locality, as each jurisdiction adopts its own LERTA ordinance.

- LERTA applies tax abatement to the value of the increase in property tax assessment due to property rehabilitation or new construction.

- Generally, major improvements to a property will trigger a property reassessment by the County Assessment Office.

- LERTA can provide up to a ten (10) year abatement that RUNS WITH THE LAND, so subsequent owners, within the ten (10) year abatement period will still benefit from the abatement incentive.

How It Works

Designation of LERTA Zones: Local governments identify and approve specific areas—often economically depressed neighborhoods or underused commercial corridors—as LERTA zones. Some municipalities will permit it on a city/ township wide area, while others may restrict LERTA to certain zones.

For instance, Lancaster city permits applications within the whole city, approved by a case-by-case basis. Each taxing authority, County, Municipality and School District must approve the abatement for their portion. The three taxing bodies do not have to agree on the LERTA, and separate taxing bodies can apply LERTA designation without the others.

Approval Process: Once a property is located in an eligible area, the investor must submit an application for LERTA benefits, typically before construction begins. This usually requires:

- A formal application to the local tax office

- Project plans

- Timelines and cost estimates

Tax Abatement Schedule: Upon approval, the property owner benefits from a graduated tax abatement. A common structure is:

Year 1: 100% exemption on the increased assessment

Year 2: 90%

…

Year 10: 10%

After the final year, the property is fully taxed at its improved value. These schedules can vary from one municipality to another, with some providing 100% abatement for a full 10 years, others with 100% for the first 5 years, and then phasing in years 6-10.

Benefits for Real Estate Investors

- Lower Carrying Costs: By significantly reducing the property tax burden during the redevelopment phase and following stabilization phase, LERTA makes holding and developing properties more affordable.

- Improved Loan Proceeds: Especially in the early years, the tax savings can directly impact net operating income (NOI), which is crucial for leveraged investments. This may provide a larger loan for the improvements, which reduces the cash outlay an investor would need.

- Stronger ROI: Since property taxes are usually the largest expense with a property, reducing this leads to significant increase in NOI. With reduced expenses and a freshly revitalized or newly built property, investors can realize stronger returns on capital.

- Increased Property Value: LERTA often acts as a catalyst for neighborhood improvement, boosting long-term property appreciation and future resale value from the neighborhood appreciation.

Ideal Investment Scenarios for LERTA

- Multifamily Redevelopment: Rehabilitating vacant or underused apartment buildings in designated zones.

- Commercial Conversions: Turning abandoned industrial or retail space into mixed-use or office facilities.

- New Construction: Developing new housing or commercial units in revitalization districts.

- Stacking with Other Incentives: LERTA can often be combined with other programs like Keystone Opportunity Zones (KOZ), New Markets Tax Credits, or Historic Tax Credits for a multi-layered incentive package.

Final Thoughts

For real estate investors focused on value-add or development strategies, LERTA offers a powerful incentive to invest in areas with untapped potential. By easing the tax burden during the crucial early years of a project, it creates a financial runway to stabilize operations and capture long-term appreciation.

If you are looking to improve property and grow your NOI, contact us to discuss strategies to improve your return and save time.

Sources

–https://yorkcountypa.gov/DocumentCenter/View/1933/Local-Economic-Revitalization-Tax-Abatement

– https://www.cityoflancasterpa.gov/local-economic-revitalization-tax-assistance-lerta/