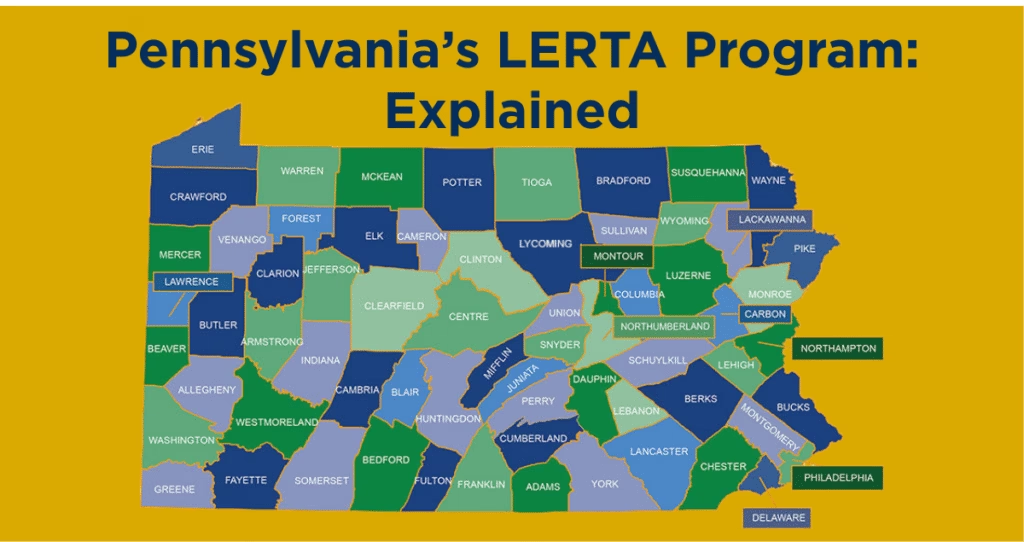

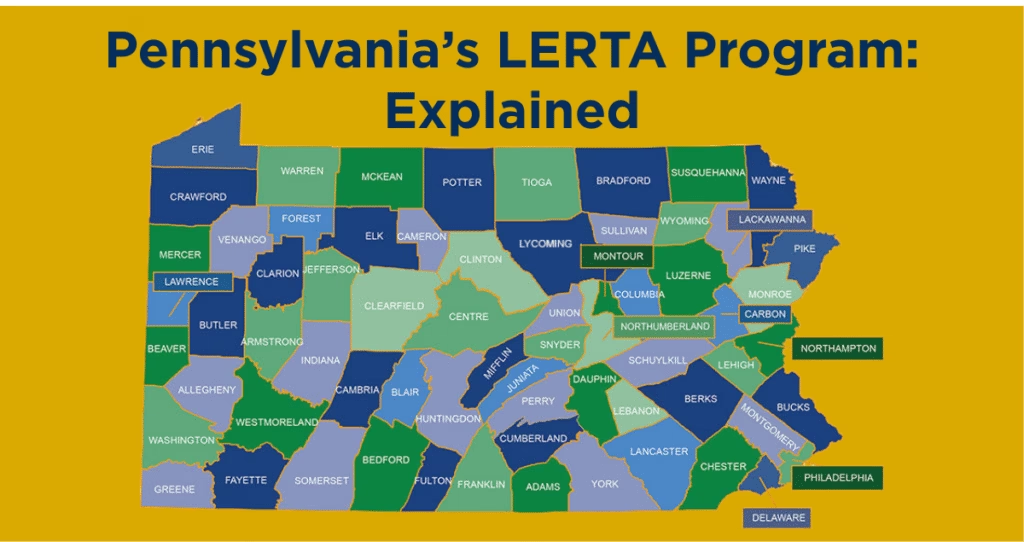

The LERTA Program Explained

For real estate investors who continue to do value add construction projects or new developments, they know that the increased cost of construction makes it

For real estate investors who continue to do value add construction projects or new developments, they know that the increased cost of construction makes it

Thanks to tariffs, we have gotten a break from the ongoing media headlines that scream ‘Increases in natural disasters!’ ‘Hurricanes are getting more frequent!’ ‘Mass

Recently we had a client who invested in placing a billboard on their property, and when it came time to sell realized a significant return

Like many Americans, I have an aging parent that is part of the Baby Boomer generation, who is now in need of care. We have

Capstone Commercial is proud to publish the fifth edition of our newsletter. This issue features an exciting update about Capstone, insights from our team about commercial property development, and a robust calendar of upcoming events.

We look forward to providing these updates each quarter. Be sure to sign up for our contact list below the newsletter to receive new issues straight to your inbox.

If you’re interested in contributing to a future edition or have comments or questions about anything in this edition, please feel free to reply to this email.

The ink is drying on the check you just wrote to your retirement account, to maximize your deductions for last years tax bill. Now, where

It is the time of year when we all start thinking about getting away in the summer. If you are thinking of moving to your

Partnerships. Entities. Multiple properties. Most investors are people of action, and taking action usually results in multiple investments, often in different entity structures. This can

One of the guys I graduated high school with went right into the trades. He knew college was not for him, but has excelled in

Landlord Ed recently shared with me his secret to keeping his costs low and keeping his tenants longer. Having low turnover is the easiest way

But it won’t cash flowwwww…. wines every investor, under traditional loan terms. Demand for great apartments or commercial investment properties has surged again, and the

What do you do with that OLD outdated Office/Church/Motel/School/Warehouse/Hospital? Many entrepreneurial investors take these properties and turn them back into living spaces with modern amenities.

This is a real estate newsletter. Why are we talking about oil and gas? Unlike investing in Nvidia, which recently had the LARGEST MARKET CAP

Recently we had a client who purchased an older apartment building, which had a low tax assessment. Now, if you invest outside of Pennsylvania, you

2024 seemed to be a collective holding of breath for real estate investors. With a more stable outlook for 2025, here is where the trends are pointing.

At the end of 2024, we surveyed our investor database to learn what the overall results were for the year. Here’s what we found.

Capstone Commercial is proud to publish the third edition of our newsletter. This issue features insights from our team on topics including cold calls, the current and upcoming market, interest rates, and more. Additionally, we are thrilled to include a guest article in this quarter’s edition from Vishnu Patel and Thomas Bream of Presence Bank. We look forward to providing this valuable content to our clients and colleagues each quarter. Be sure to sign up for our contact list below the newsletter to receive new issues straight to your inbox.

Naomi Brown, CCIM was pleased to represent the sale of 128-134 Baltimore Street in Hanover, Pennsylvania. Background 128-134 Baltimore St was a mixed-use property along

Fill out the form below to download our free PDF!