One of my personal friends hates real estate. To much work. All the hassle. Why bother when you make the same return in the stock market?

Naturally, I am always talking up how great real estate is. But his reply to pacify me- “I will just buy a REIT and save myself the stress”.

But part of what I love about real estate are the tax savings….are REITs as tax efficient as direct real estate ownership?

Let’s explore.

Real Estate Investment Trusts (REITs) are a popular choice for investors like my friend, seeking exposure to real estate without the burdens of direct ownership. One important feature of real estate investing is depreciation—a tax-deductible expense that allows property owners to write off the cost of buildings and improvements over time.

But how does depreciation work in a REIT structure, and what happens to those depreciation write-offs?

While a steady flow of payments may sound enticing, REIT dividends come with unique tax consequences for investors. These payments can constitute ordinary income, capital gains, or a return of capital—each of which receives different tax treatment. Below, we explain how REITs work and what investors should know about the potential tax implications.

Understanding REITs

A REIT, by definition, is a corporation that owns and operates income-producing real estate and meets certain IRS requirements, such as distributing at least 90% of taxable income as dividends. A REIT is exempt from corporate taxes, provided they meet the IRS requirements for distribution of 90% of taxable income and follow the investment criteria with 75% or more of holdings invested in real estate. REITs, like other real estate owners, claim depreciation on their owned properties to reduce taxable income.

REITs function similarly to mutual funds but focus on real estate rather than stocks and bonds. They pool capital from many investors to acquire, manage, and develop diverse types of properties. Investors can benefit from REITs in two primary ways: regular dividend payments and potential appreciation of the REIT’s share value.

As of 2024, REITs are available in more than 40 countries and have surpassed $2 trillion in market capitalization. REITs are attractive to investors seeking higher yields than those in traditional fixed-income markets, like bonds.

The versatility of REITs is evident in their wide range of properties. From apartment complexes and office buildings to more specialized assets like data centers, healthcare facilities, and even timberland, REITs offer exposure to virtually every sector of the real estate market. While some REITs specialize in specific property types, others maintain diversified portfolios.

Taxation for Unitholders

The dividend payments REIT investors receive are:

- Ordinary income

- Capital gains

- Return on capital

This will all be broken down on the 1099-DIV that REITs send to shareholders yearly.

Ordinary Income

Generally speaking, the bulk of the dividend is income is treated as ordinary income to the investor. This part of the dividend is taxed according to the investor’s marginal tax rate.

The part of the REIT dividend attributable to income may receive further preferential tax treatment under the Tax Cuts and Jobs Act (TCJA) of 2017. The act gives a 20% deduction for pass-through business income, which includes qualified REIT dividends. The deduction expires at the end of 2025, but may be renewed in the 2025 budget year.

Capital gain or loss

This occurs when the REIT sells property held for at least one year. The capital gain or loss is also passed along to the investor, with gains taxed at 0%, 15%, or 20%, depending on the investor’s income level for the year the gain was received.

Return on Capital

Depreciation affects REITs differently compared to direct real estate ownership.

Because REITs must distribute most of their taxable income as dividends, depreciation can reduce the amount of taxable income a REIT reports, thereby allowing it to distribute more cash not subject to tax. Because of a REIT’s structure as a corporation, the depreciation deduction cannot ‘pass through’ to the investor the way it would if the investor owned it directly in an LLC.

For this reason, a part of the dividend may be listed as a nontaxable return on capital on an investor’s 1099 DIV. This can happen when the REIT’s cash distributions exceed earnings, for example, when the company takes large depreciation expenses. There are two things to note about a return of capital:

- This part of the dividend is not taxable for the year it is paid to the unitholder. It’s taxed later.

- A return of capital lowers the unit holder’s cost basis. When the investor sells their units, this payment is taxed as either a long- or short-term capital gain or loss.

If enough capital is returned to the investor and the cost basis falls to zero, any further non-dividend distributions are taxed as a capital gain.

- On REIT financial statements, depreciation reduces net income. But this accounting treatment does not affect the REIT’s cash flow, which is why investors often focus on Funds From Operations (FFO) rather than net income when evaluating REIT performance.

Example of Unitholder Tax Calculation

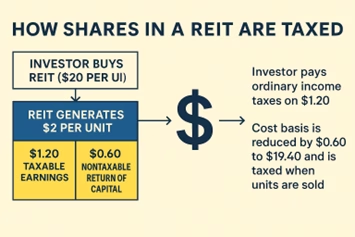

An investor buys shares of a REIT trading at $20 per unit. The REIT generates $2 per unit from operations and distributes 90% (or $1.80) to unit holders. Of this, $1.20 of the dividend comes from earnings. The remaining $0.60 comes from depreciation and other expenses and is considered a nontaxable return of capital.

The investor would pay ordinary income taxes on the $1.20 in the year in which it was received. Meanwhile, the investor’s cost basis is reduced by $0.60 to $19.40 per share. This reduction in basis will be taxed as either a long- or short-term gain or loss when the units are sold.

How Are REITs Taxed compared to common stock?

Most REIT dividends are taxed as ordinary income at the investor’s marginal tax rate rather than the lower qualified dividend rate, which would apply to dividends from regular stock holdings. When an investor sells REIT shares, any appreciation is also subject to capital gains taxes.

- The reason REIT dividends are taxed at the investor’s marginal tax rate, instead of the lower Qualified Dividends rate for common stock, is because of double taxation. A standard Corporation like General Motors will pay tax at the corporate level, which is why investors are permitted to pay a lower tax rate on their dividends, since it is double taxation.

- Since REITs are passing through the profit without paying any tax, the investor pays taxes on the income at their standard tax rate. This is also the same rates they would pay on real estate investment income if held directly.

Remember that some REIT distributions may be classified as a return of capital. These are not taxed immediately but instead cut the investor’s cost basis in the REIT shares. This can result in higher capital gains taxes when the shares are eventually sold.

How is a REIT taxed compared to a Private Real Estate Fund?

- REITS and ‘Real Estate Fund’ models differ mainly in the ownership structure- a REIT is a corporation that distribute Dividends to investors on form 1099 DIV. Income and expenses are calculated on the REIT level, with 90% of any taxable income being paid out.

- Fund models are usually LP’s or LLCs that act as a pass-through entity, providing K-1 Statements to shareholders and all profit and loss it passed through.

Because of the requirement to distribute their returns, and limited ability to pass through depreciation write offs, REITs usually invest in larger stabilized properties.

Private Funds set up to invest in real estate generally focus on value-add opportunities to maximize returns and provide tax write offs to their investors.

So, while investors in private real estate or syndications (e.g., via a limited partnership) may get to claim depreciation directly on their tax returns, REIT shareholders do not. However, they still may benefit indirectly through more tax-efficient dividend distributions.

Conclusion

Understanding how depreciation functions within a REIT is key for investors comparing real estate investment options. Those seeking direct tax benefits from depreciation may prefer private real estate investments or syndications, while those favoring liquidity, diversification, and simplicity often find REITs to be an efficient vehicle—with tax advantages baked in through smart accounting and tax strategy.

Many of our clients appreciate the diversification that we advise, so that they have consistent cash flow from many sources. If you are ready to take the next step in your real estate journey, contact us to schedule a strategy coffee.

Video

Sources

https://www.sec.gov/files/reits.pdf