Guest Authored by Thomas Bream and Vishnu Patel of Presence Bank

If you have done any borrowing recently to finance a commercial real estate project, you have likely been offered a hedge product from your bank. These hedge products are sometimes referred to generically as a swap and they have become increasingly popular for both borrowers and the banks. To get started, let’s define a hedge.

A loan hedge is an exchange of cash flows that fixes the interest rate on an adjustable-rate loan. The fixed rate (or swap rate) equals the average of the market’s expected future adjustable rates for the defined term.

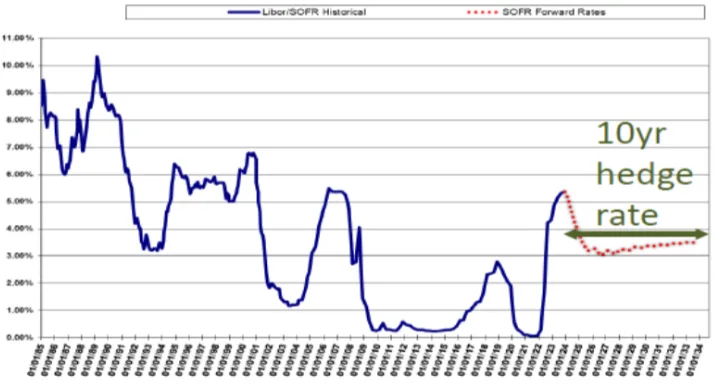

In other words, the futures market prices adjustable rates over a defined period of time and the average of those adjustable rates represents the hedge rate offered to the borrower (see chart below). Hedge durations typically vary from as short as 1-year to as long as 15-year.

From a borrower’s point of view, the borrower is exchanging their “risky” variable rate for a “stable” fixed rate using a third-party intermediary. The loan hedge allows the borrower to fix the interest rate based on the market’s expectation of future rates because the loan hedge rate incorporates the expected future interest rates. In our current economic environment, the yield curve is inverted so projected future interest rates are lower than the near-term investment rate, resulting in relatively attractive fixed rates when using a hedge.

However, what about the bank’s point of view? Why would a bank offer you a hedge rate as opposed to the traditional 5-year fixed rate? Furthermore, why do most bank traditional fixed rates typically only offer a maximum of a 5-year duration or less?

To start with, when banks price a traditional bank fixed rate they are committing to maintaining that interest rate for the defined period of time regardless if rates increase or decrease after the loan closes and therefore are taking on interest rate risk. If market rates increase after the loan closes, the bank is missing out on the opportunity to receive a higher return on their loan. Conversely, if market rates decline the bank is benefitting from having the loan provide a higher rate of return. One thing is for certain, accurately predicting future interest rates is an impossible task. That is why banks typically only will commit to a 5-year traditional fixed rate or less so they can reduce the risk associated with interest rate volatility over a relatively short period of time.

Contrast the traditional fixed rate to the hedged fixed rate and you can understand why banks may favor this approach. Previously it was noted that the underlying loan for the hedge product is priced as a variable rate to the borrower. Therefore, the bank is able to enjoy the benefit of not taking interest rate risk on the loan because it will reprice with market ups and downs, However, the borrower receives the benefit of entering into a Rate Conversion Agreement with a third-party intermediary that will offer a fixed rate in exchange for the variable rate offered by the bank. In most cases, the fixed rate offered by the intermediary will be lower than the traditional bank fixed rate because the bank understands that they are not subject to interest rate risk since the underlying loan remains at a variable rate. In addition, the hedge rate can fix the interest rate for longer periods of time which may be up to 15-years because the interest rate risk is no longer held by the bank but by the third-party intermediary. This means the borrower may be able to lock in their future cash flows by fixing the debt payment for a longer period of time. Therefore, the borrower benefits from a lower fixed rate than the traditional fixed rate and can extend the fixed rate period for a longer period of time.

The hedge rate is determined by using an index which is most often the CME 1-month term SOFR (Secured Overnight Financing Rate) plus a credit spread determined by the bank. Each bank will have a separate credit spread target but historically it may average 250 basis points.

This is the underlying variable rate offered to the borrower. As an example, the current CME 1-month term SOFR is 5.34%. Adding to the credit spread of 250 basis points would make the underlying variable rate paid from the borrower to the bank 7.84%. This rate is exchanged for a fixed rate between the borrower and the third-party intermediary which will result in a lower fixed rate based on the current inverted yield curve (ie. in the area of 6%).

The question then becomes: what option should a borrower take? The answer, like most in these types of situations, is – it depends. Contrary to widespread misperceptions, the hedge product does offer some reasonable flexibility. For instance, hedge rates can be portable. If the borrower elects to sell the underlying property in the future but wishes to maintain the rate booked today, it may be applied to a different property or blended into a larger loan facility. Additionally, the hedge rate can be assumable subject to the bank approval. If the borrower elects to sell the property and the buyer perceives value in the existing loan terms, the buyer may assume the loan and rate. Another benefit is hte prepayment provision symmetry feature. In a traditional bank fixed rate, the borrower will typically pay a premium to prepay the principal balance of the loan unless the borrower negotiates some flexibility in the prepayment language. This premium is applied regardless of the interest rate environment. With the hedge rate, if the loan is prepaid when rates are lower, a fee is owed, but if rates are higher the borrower may collect a fee upon prepayment.

So, what happens if a borrower enters a hedge rate and interest rates decline significantly in the future? First of all, it’s important to remember that the goal of financing real estate with debt is to provide predictable future cash flow which the hedge product can do for a longer duration of time to remove interest rate volatility. However, if market rates decline significantly and the borrower wishes to amend the Rate Conversion Agreement, the interest rate may be modified by adjusting the terms. The phrase “blend and extend” is often used in these situations. The borrower is essentially resetting the hedge rate and extending the duration of the hedge to lower the interest rate. While this flexibility is valuable, it is important to note that the interest rate will indeed be lower but will unlikely be at the lowest market rate depending on the remaining duration of the hedged rate and the current interest rate environment.

In conclusion, discuss your options with your banker to determine the best solution available. In the current economic climate, an interest rate hedge will likely be your lowest interest rate available compared to traditional fixed rates. Hedge rates can favor both the bank and the borrower.