We recently talked to an investor who purchased a large multifamily building in Reading. This investor was based in New Jersey, but like many folks from Jersey, they were seeking affordability in PA markets.

This investor charged through their due diligence and was prepared to close with a local lender they knew in the NJ market. However, this lender as part of their conditions had put that an ALTA survey was a requirement of the loan.

The investor was purchasing direct- and was not aware that this could be a requirement. In PA, an ALTA is not required by title companies all the time, and so closing approached without the ALTA.

Thankfully they were able to obtain an extension of time from the seller, and order a rush ALTA survey, which was received in the nick of time to meet their closing date.

So why do some states require an ALTA, and what is it, and why do investors need it?

While not required in all jurisdictions, ALTA surveys are often demanded in many commercial real estate deals, especially where title insurance or lenders require it.

What is an ALTA Survey?

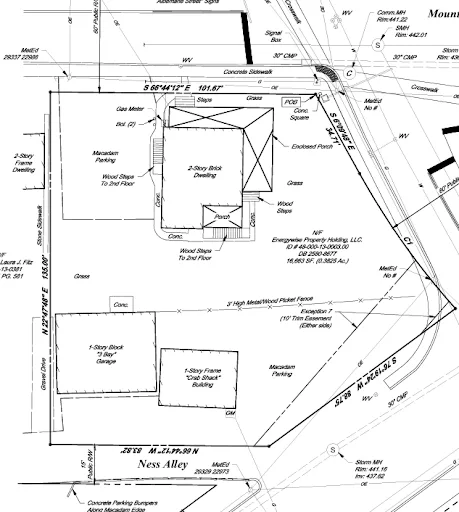

An ALTA survey is a detailed land survey developed according to joint standards by the American Land Title Association (ALTA) and the National Society of Professional Surveyors (NSPS). It provides a comprehensive map of a property’s boundaries, improvements, easements, rights-of-way, access points, zoning classifications, flood zones, and other critical features that may affect ownership and use.

Unlike a simple boundary survey or plat, an ALTA survey is conducted in conjunction with a title commitment and includes Schedule B-II exceptions—the encumbrances and limitations listed in the title work. This integration helps uncover conflicts between recorded documents and the actual physical use of the property.

Example of ALTA survey

Key Components of an ALTA Survey

Some of the most valuable elements of an ALTA survey include:

- Boundary lines and corners as verified by a licensed land surveyor

- Recorded easements and encroachments, such as utility lines or shared driveways

- Setbacks, building footprints, and access points

- Legal description verification (matching title and deed language)

- Public and private rights-of-way (like alleys, roads, or paths crossing the property)

- Improvements and utilities (visible or known, above or below ground)

- Flood zone classification per FEMA maps

- Optional Table A items, which can include zoning designations, parking counts, topography, and more depending on what the buyer, lender, or title company requests. See Example Here: https://altalandsurvey.com/wp-content/uploads/2021/01/2021-ALTA-Table-A-Items.pdf

Why Lenders and Title Companies Often Require ALTA Surveys

Lenders, especially national or institutional ones, often require an ALTA survey before closing on a commercial real estate loan. Why? Because it identifies any conditions that could impair the property’s value or legal use, which may not be found in public records alone.

Title insurers also use the survey to determine whether they can offer survey-related endorsements, which provide coverage for issues like encroachments, unrecorded easements, or access problems. Without an ALTA survey, these endorsements are generally unavailable.

Why Some States Require ALTA Surveys – and Others Don’t

The need for an ALTA survey isn’t uniformly mandated by law across the U.S. Rather, it’s driven by customary practices, risk tolerance, lender policy, and title insurer requirements—all of which can vary by state.

For example:

- Pennsylvania: ALTA surveys are not a blanket legal requirement in Pennsylvania because State regulations primarily focus on boundary surveys and adherence to Pennsylvania’s property laws.

- Maryland: Often required by lender and title companies to ensure the site conditions are accurate and insurable.

- Texas and Florida: ALTA surveys are frequently required due to complex legal descriptions, older subdivisions, or historical issues with encroachments.

- New York: Local legal custom often relies more heavily on attorney title opinions, and ALTA surveys are less frequently ordered unless required by the lender.

- California: Surveys may be waived on urban parcels if there are no known encroachments and the legal descriptions are clean, but rural and hillside properties often need detailed survey work.

In short, there is no uniform legal mandate—but practical and legal realities on the ground often dictate the need for an ALTA survey, especially in complex or high-value transactions.

5 Benefits to Using the ALTA Survey

- Uniform Standard. The ALTA standards are a uniform nation-wide survey standard. These national standards make it easy for the title company to review the survey and write title insurance on the property.

- Encroachments/Easements Shown. Encroachments are when a property owner violates the property rights of his neighbor by building something on, or over, the neighbor’s land. If described sufficiently, an ALTA survey should show potential encroachments and plot recorded easements on the survey drawing.

- ALTA Table A Items. The ALTA survey standards include a list of optional items (Table A) that may be needed and ordered when the original survey is ordered. This may save money since the work is done at the same time as the boundary survey.

- Title Exceptions. Title exceptions matter when not covered by the title policy, leaving owner open to liability. Some exceptions deal with matters which may be found by an accurate survey of the property; encroachments, for example. Completion of an ALTA survey allows the title insurer to remove those exceptions.

- Consistent Scope of Work. Usually the hardest part of any contract is determining the scope of work and how it will be completed. The ALTA survey standards provide a consistent scope of work that has been used since 1988 and is frequently reviewed and updated to conform to the latest technology and legal issues.

Conclusion

An ALTA survey is a helpful and consistent tool for commercial real estate investors, to make sure all conditions of the property are known. Making sure you don’t find a ‘surprise’ easement or issue later is an important part of mitigating your risk in a real estate transaction. While not required in all states, it can be a useful tool to provide consistency across your portfolio.

Many investors we work with understand that a balanced approach to real estate that blends confident acquisition and risk review is important. We help investors take a consistent approach to build long term wealth for their families. If you are looking to grow your investments, contact us to discuss your next steps.