Commercial vs. Residential Real Estate: Four Key Differences

What is the difference between commercial and residential real estate? It’s a question that comes up often, and there are a few different ways people

What is the difference between commercial and residential real estate? It’s a question that comes up often, and there are a few different ways people

Recently I had a situation come up in a sale that made me realize that real estate is changing. Real estate has always evolved as

Which is better, a small multifamily property with one to four units, or a larger property with five units or more? The debate rages on,

My friend George has a nice 40 unit building that he purchased when his kids were little. Now they are grown, and over the years

Real estate is the world’s largest asset class, with an estimated value of $240 trillion – over three times the value of the global stock

If you’re thinking of doing a 1031 exchange, you need to understand how depreciation is handled before you move forward. Otherwise, you could lose out

So what requirements are there if you want to get a commercial loan? There is definitely a difference between residential and commercial loans, and understanding

Real Estate is an in-efficient market, which means that those that have more knowledge can benefit from greater cash flow than those who do not

If you’re an investor who has ever wondered whether it makes sense to invest in real estate outside the United States, you’re not alone. It’s

If you’re an investment property owner, you’ve probably shopped for a property manager and wrestled with the same question many owners face. Is it better

Over 55% of all investment real estate owned in the US is owned by a ‘Baby Boomer’, those who are currently between 60-80 years old.

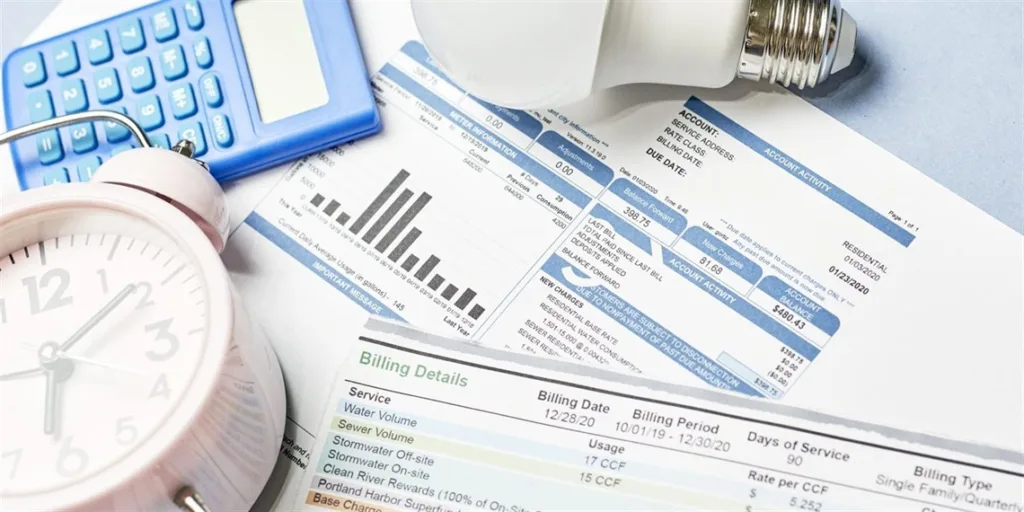

Charging tenants for utilities is one of those areas in real estate where small decisions can have a big impact. When it’s done correctly, utility

If you’re a real estate investor, you’ve probably looked at a lot of offering memorandums from brokers, or statistics on multifamily buildings, and noticed rents

by Michael Kushner, CCIM “Location, location, location.” This timeless real estate adage has never been more relevant than it is today. But in the modern

Do you need an attorney to buy investment real estate? That is a question I get asked a lot. The honest answer is no, you

How do commercial realtors advertise multifamily property? We hear this often from new investors. People who are familiar with residential real estate often wonder why

Since recent announcements about increasing Fed purchases of Treasury securities, and Trump’s directive to Fannie Mae and Freddie Mac to increase their purchase of Mortgage-backed

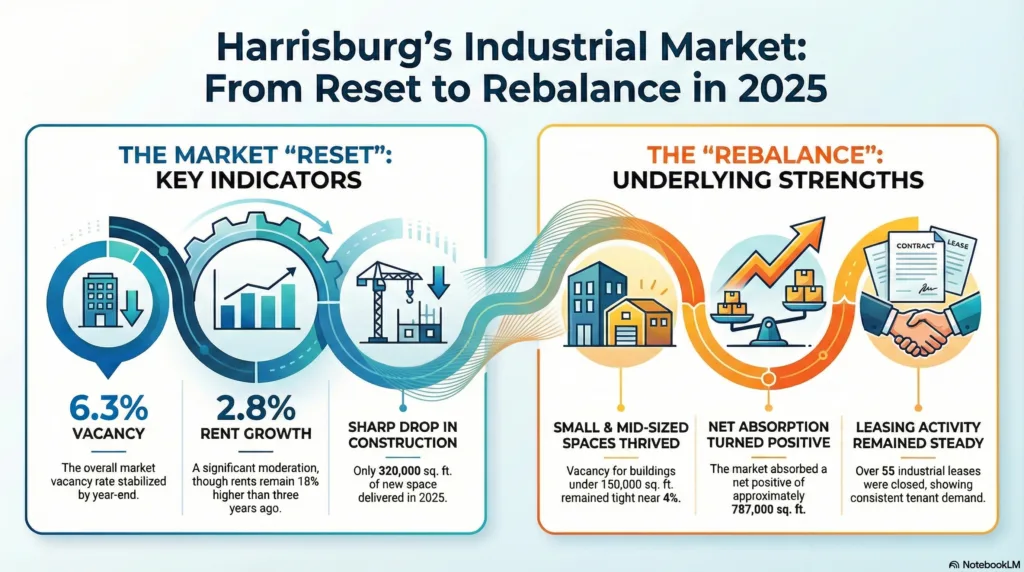

by Michael Kushner, CCIM From Reset to Rebalance The Harrisburg industrial market spent 2025 doing something healthy and necessary. It reset. After several years of