I was asked recently if I actually write these newsletters. Yes, it is me, a real human using my experience as a broker and my curiosity as an investor, to share insights and explore investment strategies.

The year of 2025 has so far proven to be an interesting one, and while we aren’t done yet, I am reflecting in the hopes that nothing major changes, except perhaps a nice big interest rate reduction.

For the multifamily owners, this has been mostly a year of maintaining, with some softening in occupancy, flattening in rents but overall stability with tenants.

Occupancy:

-Renters are staying longer. Current renters are generally in good shape with solid jobs.

-A quick indicator is when a tenant loses their job, they will ask to terminate their lease.

-With a low turnover rate, this indicates the job market appears to be doing well and existing tenant base in good shape.

-New prospective renters are cautious though, and new lease signings have slowed as overall new household formation has slowed. This can be an indicator for new college graduates having a tougher time finding a job, and overall caution on what is happening, especially given the government shutdown.

-The vacancy is holding fairly tightly at 6.6% in the Central PA region

Rent Growth:

-Rent growth has slowed to 3%, with more incentives offered in lease up of newer Class A product.

-Average rent is hovering at $1,411

-Income growth has caught up to rent growth: since 2020, rent growth had exceeded income growth every year, with affordability becoming the biggest concern. Now that balance has come back into equilibrium, per the stats below.

An increase in the supply of new units has helped to tamper down the rent growth in equilibrium to the income growth, which again shows that the way to fix affordability is more supply!

In many cities throughout the US, they have tried to enact rent control to bring prices down, but the true way to increase affordability is basic supply and demand principals. Build baby, build.

The slowdown in rent growth has allowed median household income, which rose from $75,258 in early 2020 to $91,890 today, to close the long-standing affordability gap.

Job Growth:

Sometimes investors forget that the best way to ensure you are buying in an area of long-term growth is the job market.

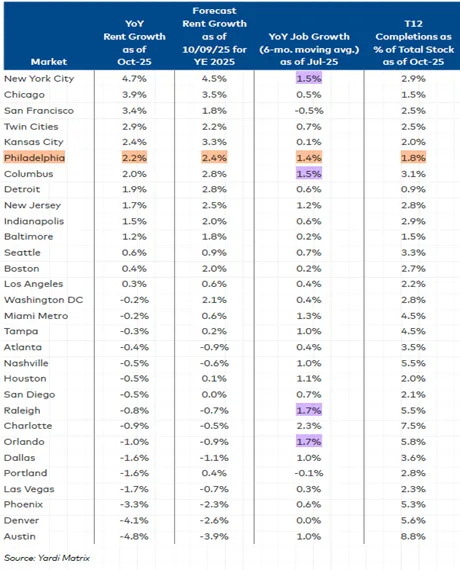

-Below you see a chart that includes the job growth for the major markets throughout the US. If you look at Philadelphia, the closest major market, you can see the job growth is one of the strongest in the country, on par with NYC, Raleigh, Orlando and Columbus.

-While some areas of the US have struggled to stay positive, PA continues to deliver consistent job growth.

Supply Growth:

Over the past 3 years, substantial apartment deliveries have been put into the housing stock:

-2,220 Units in Greater Harrisburg (Dauphin & Cumberland County)

-1,270 in Lancaster

-910 in York

New building has slowed as interest rates and costs have climbed, but with solid demand dynamics in the region, current approved plans are still going vertical, and more units continue to be planned, albeit at a slower rate.

Because of the limiting factors of land zoned for Multifamily housing, Central PA’s new supply is kept limited relative to the population growth.

Average Price:

-Average Price per Unit: $137,549

While overall sales volume has been lessened by the macro market conditions, the solid demand dynamics in Central PA has kept prices rising.

-Lancaster: $137,910 (Last Year $136,069)

-York: $135,225 (Last Year $101,540, 26% growth)

-Dauphin: $125,810 (Last Year $107,736)

-Cumberland: $151,251 (Last Year $103,977)

While Cumberland took the highest price, and most increase, several higher priced sales in 2025 lifted this number more than the average. Lancaster County started with the highest pricing, but the rest of the region has accelerated to close in on similar pricing.

Conclusion:

For investors looking for leading indicators, it seems apparent that the solid job market, limited new supply and growing investor interest will continue to make acquiring more units in Central PA a solid move for future growth.

Many investors we work with appreciate the active forethought we put into the bigger picture of their investments, so they can rest easy knowing the market is working in their favor.

If you are looking to grow your investments in PA or MD, reach out to us to discuss your strategy and criteria for your next investment move.

Video

Sources:

https://www.multihousingnews.com/top-markets-for-multifamily-investment/

-Our own data of sale tracking throughout Central PA. The construction statistics are from our own tracking of this supply, and may exclude some projects that we do not have data on. We do not warrant this data and each investor should do their own research.