Since recent announcements about increasing Fed purchases of Treasury securities, and Trump’s directive to Fannie Mae and Freddie Mac to increase their purchase of Mortgage-backed securities (MBSs), the interest rates have been reacting in both directions.

Understanding how the interest rate is influenced can help investors make smarter decisions about where and how to manage their property loans.

1. Why the 10-Year Treasury Matters So Much

If you invest in real estate long enough, you’ll hear this phrase repeatedly: “Watch the 10-year.”

The 10-year U.S. Treasury yield is the single most important benchmark influencing borrowing costs across the real estate market. Whether you’re financing a multifamily deal, refinancing an office building, or underwriting a long-term hold, movements in the 10-year Treasury quietly shape interest rates, investor returns, and ultimately property values.

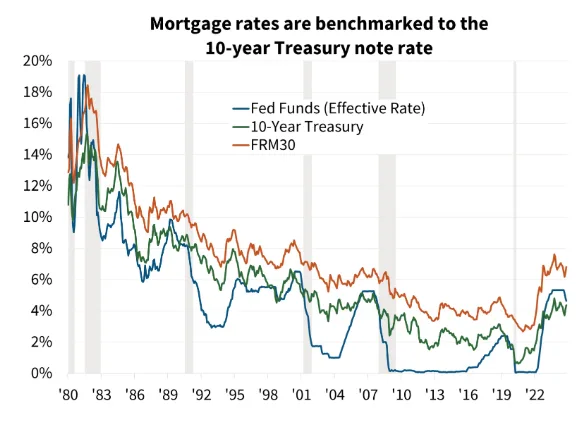

- The 10-year Treasury yield is a key benchmark for fixed-rate mortgages; when its yield rises, mortgage rates generally rise, and when it falls, mortgage rates tend to fall, because lenders price mortgages by adding a spread (covering costs, profits, and risk) to the 10-year Treasury rate, making it a strong indicator for long-term borrowing costs.

- This relationship holds because investors buying mortgage-backed securities (MBS) need to earn a competitive return compared to the relatively safe 10-year Treasury, so higher Treasury yields push mortgage rates up to attract investment.

- At its core, the 10-year Treasury yield represents the market’s view of long-term risk-free returns. Investors around the world use it as a baseline for pricing everything from mortgages to corporate bonds.

For real estate investors, the connection is straightforward:

Long-term fixed-rate real estate loans are priced as a spread over the 10-year Treasury.

Most permanent financing—especially agency, CMBS, life company, and long-term bank debt—moves directionally with the 10-year, even if not tick-for-tick.

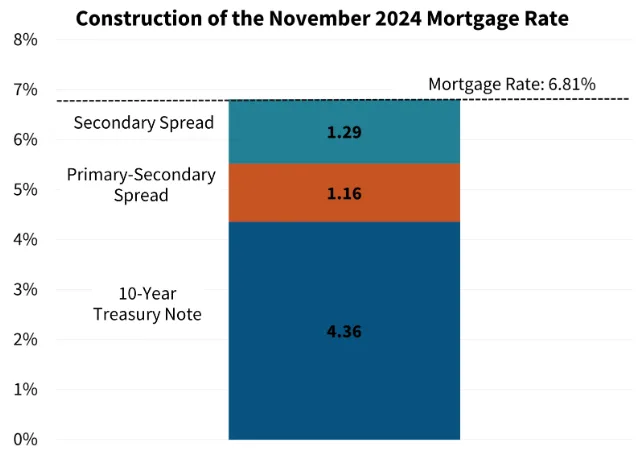

The mortgage rate offered to borrowers is determined by adding a spread to the benchmark 10-year Treasury note.

- The mortgage spread can be broken into two major components: the primary-secondary spread, which represents industry origination costs such as servicing fees, guaranty fees, and other lender costs and profits.

- The secondary spread, which represents the additional risk that investors take on when investing in an MBS relative to investing in a 10-year Treasury.

The two components of the mortgage spread are show in the graph below.

A common investor mistake is assuming mortgage rates move directly with the Federal Reserve. They don’t—at least not in a clean, linear way.

2. Treasury Yields vs. the Fed Funds Rate

The Fed controls the overnight lending rate, not long-term yields. The overnight rate is what banks lend to each other on a daily basis. The 10-year Treasury is set by the bond market, based on expectations for:

- Inflation

- Economic growth

- Future Fed policy

- Global demand for U.S. debt

This is why mortgage rates can fall even while the Fed is holding rates steady—or remain elevated after the Fed begins cutting. The bond market is forward-looking; real estate investors should be too.

3. Residential Rates Vs. Commercial- Why are they different?

Most residential loans are made under conforming loan guidelines provided by the GSEs: Fannie Mae and Freddie Mac primary.

- These entities ensure consistent standards and provide guarantees as a result of these standards, which make them eligible to bundle and sell as a mortgage-backed security.

- The GSEs also provide loans for multi-family properties, with loans starting around $1.5 million, and better rates at the $3M threshold and larger. Very careful standards must be followed in order to meet the guidelines and receive the guarantees from the GSEs. Rates are frequently better than a 30-year residential rate for high quality GSE Multifamily loans because the borrowing costs and risk premium, ‘The spread’ is lower for these agencies backed Multifamily loans.

Outside of those agencies, most commercial real estate is funded with alternate lending from banks, credit unions, and large life insurance companies. Most of this lending is kept in their own portfolios.

- Commercial bank mortgage rates are typically about 50 to 100 basis points (0.50% to 1.00%) higher than the prime, 30-year residential mortgage rate.

- Commercial mortgage rates on SBA loans and USDA loans are typically 2% to 2.5% higher than the prime residential mortgage rate.

There are commercial mortgage-backed securities (CMBS) which have very stringent standards to meet in order to be sold as a security.

- Primarily one of the most erroneous standards by property owners’ viewpoint is that a CMBS must not be modified in any way, and if paid off early, holds significant prepayment penalties in order to guarantee the yield.

- The commercial mortgage rates of life companies and conduits – because the loans are typically quite large ($3MM+) – are a little better than the commercial mortgage rates of the typical bank. You can expect to pay 35 to 75 basis points (0.35% to 0.75%) over the prime, 30-year residential mortgage rate.

4. The Role of the 5-Year Treasury: Increasingly Important

In recent years, investors have also had to pay closer attention to the 5-year Treasury, which plays a growing role in short-to-medium-term financing and transitional debt.

Conventional wisdom will have most people comparing mortgage rates to 10yr Treasuries, but 5yr Treasuries are currently a better benchmark and will provide a more realistic idea of what is happening to spreads.

This is because the 5-year Treasury more accurately, reflects the volatility in the market with a shorter timeframe.

The 5-year Treasury heavily influences:

- Bridge loans

- Short-term bank financing

- Transitional debt

- Value-add and repositioning strategies

Many floating-rate loans are priced off SOFR, but lender hedging and fixed-period pricing often reference the 5-year Treasury. As a result, changes in the 5-year yield can directly impact:

- Rate caps and swap costs

- Refinance assumptions

Right now, because of the volatility in the market, investors should pay attention to the 5 year Treasury as well.

5. Strategic Moved Investors should make

If you are an investor with loans that will come due or float within the next two years, you should consider if the coming year is the right time to refinance.

- Because rates are headed lower, it would also be a good time to sell a property as cap rates will become compressed because interest rates are falling.

- Since interest rates will likely float lower over the year, if you have any short-term financing, choosing a floating rate may be a smart move.

- Negotiate for my winning position: In this environment, the spread matters as much as the base rate. If you are financing a strong asset at a large value, negotiate for better terms as lenders will be more aggressive.

A well-negotiated loan at a tight spread over the Treasury can outperform a cheaper headline rate with restrictive terms.

Bottom Line

Real estate investors who carefully watch the bond market and understand the factors in play can make smart decisions and use the market in their favor. Timing on loans and the interest rate received can make a the difference between a break even investment and superior cash flowing asset.

Many investors we work with understand that making careful decisions to allow the market to work in their favor is one of the easiest ways to make money.

If you are looking to sell or buy when the market is working with you, contact us to ensure you get the strong return you are planning on. Get started today to ensure the best market timing.

Video

This is a lot of information! If you’re a visual learner, check out our video on interest rates:

Sources

–https://housingbrief.com/article/696147fd64564746d79f4d43/6364f688722336658f18e1c7

–https://www.fanniemae.com/research-and-insights/publications/housing-insights/rate-30-year-mortgage