by Michael Kushner, CCIM

Interest rates impact both personal and business finances by determining the cost of borrowing, and the returns on saving. Individuals rely on loans for significant purchases like homes, cars, or education, while businesses often borrow to fund long-term investments. What many may not realize is that banks, too, are borrowers – often from individuals, through personal savings accounts. When you deposit money, you’re effectively lending it to the bank, which then pays you interest on that loan. As interest rates rise, borrowers face higher costs, while savers benefit from better returns.

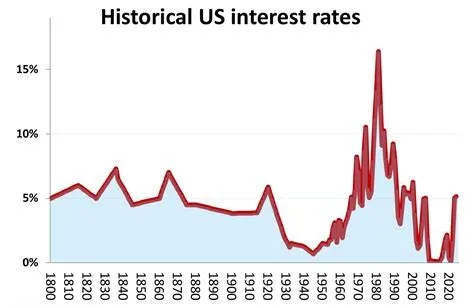

Lately, in the United States, interest rates have been high. We’re always trying to figure out where exactly the Federal Reserve will land on rate cuts or increases, but it’s anyone’s guess what J. Powell will decide at any given time. Let’s start with a primer on what interest rates are and how they’re determined.

How are interest rates determined?

In the United States, the Federal Reserve (otherwise known as The Fed) sets the benchmark interest rate known as the federal funds rate. This is the rate banks charge one another for overnight loans. This rate influences what’s called the primate rate, which is used for loans like credit cards, home equity loans, and adjustable-rate mortgages. The prime rate is typically about 3% higher than the federal funds rate.

Banks also assess individual borrower’s creditworthiness to determine the interest rate on their loans. Those with low credit scores face higher rates due to the increased risk of default, while individuals with high credit scores often receive more favorable rates.

Fixed vs. Variable Rates

there are two primary types of interest rates- “fixed” and “variable”. Fixed rates remain the same for the loan’s duration, offering predictability in payments and protection against interest rate changes. In contrast, variable rates fluctuate in accordance with changes to the primate rate, making them more susceptible to increases or decreases based on economic conditions. For example, a mortgage with a variable rate could become more expensive if the prime rate rises, but it will decrease in a low interest rate environment.

High vs. Low Rates

High interest rates make borrowing more expensive and can slow down both consumer and business spending, reducing the overall demand. Conversely, low rates encourage borrowing and discourage heavy saving, stimulating purchases like homes and cars, while also making business expansion more affordable. However, low interest rates come with the risk of inflation, where the cost of goods and services increases and the purchasing power of the dollar is reduced.

Final Thoughts

Understanding how inflation rate changes work can help borrowers and savers make informed decisions in both personal and business financing. Keep an eye on central bank policies to help navigate shifts in the economic landscape, and remember that what goes up must come down (and vice versa)!