The year 2025 will be a pivotal year for tax law in the US, as many of the Tax Cut and Jobs Act legislation will expire if the legislature does not act to reinstate them.

There are also several ‘hot button’ tax treatments that may be changed in order to bring compromise needed to reinstate some tax treatments.

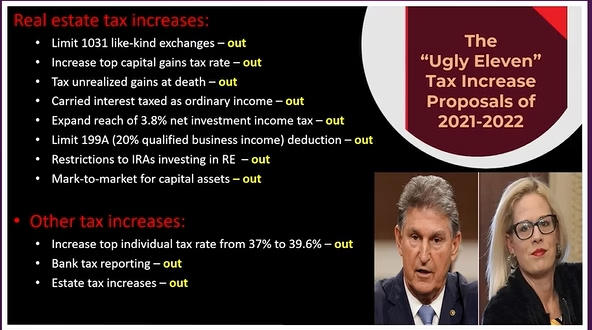

The National Association of Realtors works diligently to protect the favorable tax treatment of real estate investments in the US, and was pleased to see the ‘Ugly 11’, shown below, that was proposed in 2021 remain out of our tax law- for now.

One of the hot button issues is Carried Interest, which we discuss further here and why it matters to real estate investors.

What is Carried Interest?

Carried interest, or “carry,” is a familiar term in private equity and real estate investing, often associated with lucrative compensation for fund managers or general partners (GPs).

While it’s commonly viewed as a performance-based reward, one of its most controversial and strategic features is its tax treatment.

- Carried interest is compensation paid to the general partner (GP) or manager of an investment funded by a group of investors (Syndication). This payment is based on the performance of the investment, usually as a share of the profits.

- The GP/manager is typically responsible for creating the entity that owns the investment asset, as well as managing the investment, so their involvement can dramatically impact the profitability of an investment. Tying their compensation for this service to the success of the investment incentivizes the GP/manager to optimize the return on investment.

Types of investment that may pay carried interest to GPs include the following:

- Private Equity

- Joint ventures

- Hedge funds

- Crowdfunding

- Real Estate Syndication

Carried interest represents a share of profits—typically 10% to 30%—allocated to the sponsor or GP of a real estate investment.

- It is important to note- this share is not based on the capital they invest, but on their role in managing and executing the deal.

- While limited partners (LPs) usually contribute most of the capital, the GP earns carried interest if the investment outperforms agreed-upon benchmarks, such as preferred returns or internal rate of return (IRR) hurdles. This if often known as the ‘promote’ to the sponsor.

Though it functions like compensation, carried interest is generally taxed not as ordinary income but as long-term capital gains, which has created both financial advantages and political scrutiny. Carried interest is earmarked along the life of the investment, but not paid out till the property is sold, shedding some light on why it is taxed as a capital gain.

The difference between Capital Gains vs. Ordinary Income

Ordinary Income:

Taxed at rates up to 37% (as of 2024, for high earners)

Applies to wages, management fees, interest income, and short-term trading profits

Long-Term Capital Gains:

Taxed at 15% to 20% for most taxpayers (plus 3.8% Net Investment Income Tax, if applicable)

Applies to assets held for more than three years in carried interest structures (see below)

Because carried interest is classified as a profits interest in a partnership, GPs are not taxed when they receive it. Instead, they are taxed only when the carry is realized—usually when the asset is sold—and, under most conditions, it qualifies for long-term capital gains treatment.

The Three-Year Holding Rule

A key change to the tax treatment of carried interest came with the Tax Cuts and Jobs Act of 2017, which extended the required holding period from one year to three years to qualify for long-term capital gains rates on carried interest.

What This Means:

- If a real estate asset is sold after being held for less than three years, the GP’s carried interest is taxed as short-term capital gains, at ordinary income rates.

- If the asset is held for three years or longer, the carry is taxed at long-term capital gains rates, significantly lowering the tax burden.

- This rule applies to carried interest in real estate and private equity, but not to gains from investments held directly by individuals, such as stocks or rental property owned personally.

Note that under a smaller group investment, where all participants are GPs, their long-term capital gain is realized in one year as is typical.

How Carried Interest Is Reported

Carried interest is typically reported through a Schedule K-1 issued to the GP as a partner in the investment entity. The character of the income—whether ordinary or capital gain—”flows through” from the partnership to the GP.

For instance:

If the underlying real estate investment is sold after three years at a profit, the GP’s share of the gain is reported as long-term capital gain on their K-1.

If sold earlier, the gain appears as short-term, and is taxed at higher rates.

Because the timing and structure of the investment affect the tax treatment, GPs often design deals to comply with the three-year holding rule, even if it means deferring a sale or adjusting the project timeline.

Legislative and Policy Debate

Carried interest has long been a political lightning rod. Critics argue that it is a form of compensation for services and should be taxed as ordinary income, especially when GPs contribute little or no capital. Supporters claim that the capital gains treatment is justified because the income depends on investment performance and long-term asset growth.

Efforts to close the “carried interest loophole” have repeatedly surfaced in Congress, with proposals to eliminate or further limit the favorable tax treatment. While changes have been proposed by both Democratic and Republican lawmakers, no sweeping reform has yet passed beyond the three-year rule. President Donald Trump has spoken up in favor of eliminating this tax treatment, so the future of it is uncertain past this year.

For now, real estate sponsors can still benefit from long-term capital gains treatment—provided they structure deals with careful attention to timing, entity setup, and compliance with IRS regulations.

Because Carried Interest applies to treatment of gains in equity funds and investments outside of real estate as well, there will be strong lobbying from many stakeholders to safeguard this tax rule.

Conclusion

Carried interest remains a valuable tool for real estate sponsors as a tax-advantaged form of compensation. However, the benefits hinge on meeting the IRS’s three-year holding period and properly structuring the partnership agreement.

If you are a sponsor who will receive carried interest, make sure you are consulting with your professional advisors to ensure you are correctly structuring your deals for maximum return.

Many investors we work with realize outsized returns because they carefully utilize tax benefits to their favor. If you are looking to grow your returns, contact us to discuss your strategy.

Sources

-https://www.gatsbyinvestment.com/education-center/carried-interest-explained#:~:text=Carried%20interest%20is%20compensation%20paid,a%20share%20of%20the%20profits.

-https://www.therealestatecpa.com/podcasts/111-carried-interest-and-management-fee-tax-issues-for-gps-and-sponsors-explained-with-kim-lisa-taylor/

-https://narfocus.com/publication-issue/view/2022-02-15-federal-tax-capital-gains-carried-interests-2#:~:text=A%20common%20practice%20among%20real%20estate%20partnerships%2C,with%20the%20property%20until%20it%20is%20sold.

-https://taxpolicycenter.org/briefing-book/what-carried-interest-and-should-it-be-taxed-capital-gain#:~:text=Carried%20interest%20is%20a%20contractual,and%20bonds%2C%20and%20private%20businesses.

– https://www.jmco.com/articles/real-estate/carried-interests-for-real-estate-funds/