Are you aware that Pennsylvania is a powerhouse in the production of energy products? With the growing demand for energy in the US, especially electricity as the nation pivots towards greener resources, there is more and more pressure on the resources that feed our energy needs.

Consider this:

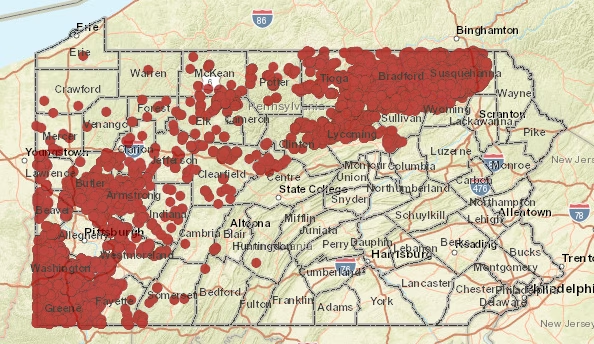

- Pennsylvania is second only to Texas in estimated total proved natural gas reserves. The state’s proved reserves more than quadrupled from 2011 to 2021 because of increased natural gas development in the Marcellus Shale Formation. The Marcellus Formation extends under three-fifths of Pennsylvania, as well as parts of West Virginia, New York, Ohio, and Maryland.

- Pennsylvania is the third-largest coal producing state after Wyoming and West Virginia. Additionally, it’s the second-largest coal exporter to foreign markets after West Virginia.

- In 2022, Pennsylvania ranked second after Illinois in electricity generation from nuclear power. However, since 2019, natural gas has surpassed nuclear energy as the largest source of in-state electricity generation.

- Over half of Pennsylvania households use natural gas as their primary home heating fuel, and the state’s 49 underground gas storage sites – the most for any state – help to meet the regional heating demand in winter.

- Pennsylvania is the second-largest net supplier of total energy to other states, after Texas.

- Pennsylvania is the third-largest producer of electricity in the nation. Only Texas and Florida generate more. Electricity generation regularly exceeds Pennsylvania’s power consumption and the state sends more electricity outside its borders over the regional electric grid than any other state.

While your real estate investments may not be tied directly to energy production, it is beneficial to understand the impact that Pennsylvania’s natural resources have on our economy. If you purchase property within the regions rich in resources, you should be aware of the significance of mineral rights – the ownership of the natural resources underground – in affecting property value.

Mineral Rights

The legal landscape surrounding mineral rights in Pennsylvania is complex and has evolved quite a bit over time. In the state, it is possible to own surface rights to a property without owning the mineral rights beneath the soil. This separation, known as a “split estate”, can lead to complications for property owners.

When purchasing property in the region of the Marcellus Shale Formation, it’s crucial for buyers to determine whether the mineral rights are included in the sale. Properties with intact mineral rights tend to be more valuable because they offer the potential for future resource extraction.

Landowners who own the air, physical surface, and physical subsurface (rock, soil, etc.) rights are also deemed to own fugitive resources while they are trapped in the pores of rock in the property owned by the landowner or while they are flowing over the land (in the case of wind or sunlight). The common law “rule of capture” provides that if neighboring property owners legally drill into their own properties and happen to drain away other landowners’ minerals, no damages are owed to the landowner whose minerals have been drained away.

Renewable Energy Solutions

In Central and Southeast Pennsylvania, we have a host of energy production contributions, even though the area is not part of the Marcellus Shale Formation’s resource region. The local energy contributions include ground solar projects, hydropower projects along the Susquehanna River, nuclear power, and power plants fired by coal and natural gas.

Economic Impact of Energy Production on Property Values

The presence of valuable minerals, such as Marcellus Shale natural gas, can significantly enhance property values. Property owners with mineral rights in this region stand to benefit financially from leasing their rights to energy companies for drilling. Because of advancing technologies, natural gas extraction can pull resources from the ground while well sites are on adjunct land. Many landowners may be able to earn fees from production under their property, without even having a well located on the property. Natural gas extraction companies can drill vertically down and then horizontally over to extract the resources from adjacent land with minimal impact on the surface. Lease agreements often provide substantial upfront payments, along with royalties based on production levels.

Outside of mineral rights, property owners may benefit from increased value from energy production uses such as solar leasing. Solar leasing can provide approximately 3 times the income that would be earned by a lease from farming, which has been enticing for many agricultural land owners.

Environmental and Social Considerations of Energy Production

While the financial benefits of owning mineral rights are significant, there are also environmental and social considerations that can impact property values. Resource extraction activities, such as drilling and mining, can have adverse environmental effects. These can include water contamination, air pollution, and landscape disruption.

However, it is important to note that while the sources of the world’s energy production are beginning to shift, things like natural gas production can produce a cleaner alternative to other energy production options.

Consider solar energy. Solar energy is a large part of the transition to renewable energy. While many neighbors do not like to see these large arrays next to them, those same neighbors still enjoy their air conditioning as much as the next person. Solar is a cleaner source of energy for that air conditioning than many other production options that are still actively in use, like coal.

Effects on the Local Economy

The development of mineral resources can also alter the local community. In areas where mineral extraction becomes a dominant industry, there can be shifts in local economies, infrastructure development, and population demographics. People with high-paying jobs move into the area, and the effects of that trickle down through the economy. For example, communities that experience a boom in natural gas drilling might see an influx of workers and increased demand for housing, driving up property prices. On the other hand, the long-term sustainability of these economic benefits is uncertain, and a bust cycle could lead to declining property values and economic instability if all of the resources have been extracted and the industry moves on.

Other sources of production, like nuclear and hydro, as well as energy-serving industries, provide a significant boost to an economy that is largely recession-resistant. Many energy sector jobs are well-paying, providing significant effects on the local economy as those high earners spend their paychecks in the area.

It is important to understand the implications of future impacts that energy production will have on the local economy. If, for example, political powers are discouraging coal-fired production, and instead urging nuclear power, consider how well-equipped the local economy will be in order to adapt to changing market conditions based on the main energy output of the area.

Conclusion

Pennsylvania is positioned to continue to be a net energy exporter for the foreseeable future. Real estate that is affected by energy trends will continue to grow in value while our nation continues to focus on domestic energy production.

If you are looking to invest in real estate that benefits from the positive economic impact of Pennsylvania’s energy production, contact us for a free call to strategize.

Videos

What other ways land can factor into your real estate investing strategy?