On July 4, 2025, the One Big Beautiful Bill Act (OBBBA) was signed into law—a sweeping tax and spending reconciliation law that cements several key provisions from the 2017 Tax Cuts and Jobs Act and introduces new incentives for developers, landlords, and investors.

For real estate professionals, this legislation was a win with several key incentives extended or expanded.

1. Preserved and Permanent Tax Incentives

- 20% Pass-Through (Section 199A) Deduction: OBBBA makes permanent the 20 % deduction for pass-through and REIT income—including rental income and REIT distributions. For married couples, the deduction phase-in thresholds are now $150,000 (up from $100,000), and $75,000 for single filers—and begins phase out above $394,600.

- 100% Bonus Depreciation: Full first-year expensing for qualified property—including nonresidential improvements, equipment, and machinery—is now permanently restored. This can be a powerful lever for cost segregation strategies.

- Business State and Local Tax Deduction (PTET): Full deductibility of business-related state and local taxes remains intact, maintaining tax efficiency for high-tax states.

- Like-Kind (1031) Exchanges Kept Alive: 1031 deferrals remain valid, allowing continued tax-deferred exchanges of investment properties.

- Business Interest Limitation: Previously the deductibility of business interest was limited to 30% of the business’s adjusted taxable income. The TCJA required the calculation of Adjusted Taxable Income to be calculated roughly on the basis of earnings before interest, taxes, depreciation, and amortization (EBITDA) for 2018 through 2021 tax years before switching to a calculation roughly on the basis of earnings before interest and taxes (EBIT) beginning with 2022 tax years.The OBBB reinstated the calculation on the EBITDA, which increases the taxpayer’s ability to write off this expense.

2. Enhanced Incentives for Development & Community Investment

- Opportunity Zones (OZ): The program is now permanent, with updates that include:

- A rolling five-year deferral for original gains,

- A 10-year tax-free treatment retained,

- A 10% basis step-up for standard OZ investments, and an elevated 30% step-up for rural OZs, which also benefit from lower improvement thresholds.

- Rural areas have a reduced investment threshold. These areas, defined as locations outside cities or towns of 50,000 people or contiguous urbanized areas, will also benefit from a reduced substantial-improvement threshold of 50% rather than the standard 100% requirement.

- Low-Income Housing Tax Credit (LIHTC): Annual allocations increase permanently by ~12%. The noncompetitive 4% credits become easier to access thanks to a reduced bond-financing threshold—now at 25%, down from 50%.

- New Markets Tax Credit (NMTC): The NMTC now has permanent status, enhancing equity-based financing opportunities in community development projects.

- Qualified Production Property Expensing: A new provision grants 100% expensing on qualified production property tied to manufacturing or production in the U.S., with construction starting between Jan 20, 2025 and Dec 31, 2028, and placed in service by 2030.

- Phantom-Income Fix for Pre-Sold Units: Developers of condominiums can now use completed-contract accounting to avoid phantom income under percentage-of-completion rules.

3. Estate, Gift, and Local Tax

- Estate & Gift Tax Exemption Raised: The unified exemption is permanently increased to $15 million per individual ($30 million per married couple), indexed for inflation. This is vital for preserving family-held real estate businesses and simplifying multigenerational planning.

- SALT (State and Local Tax) Deduction: increased the deduction from $10,000 to $40,000 limit on the federal deduction for state and local taxes, known as SALT. This deduction phases out for incomes between $500,000- $600,000.

4. Other Notable Provisions

No Carried Interest Reforms: The current favorable tax treatment for carried interest remains unchanged—good news for sponsors and fund managers.

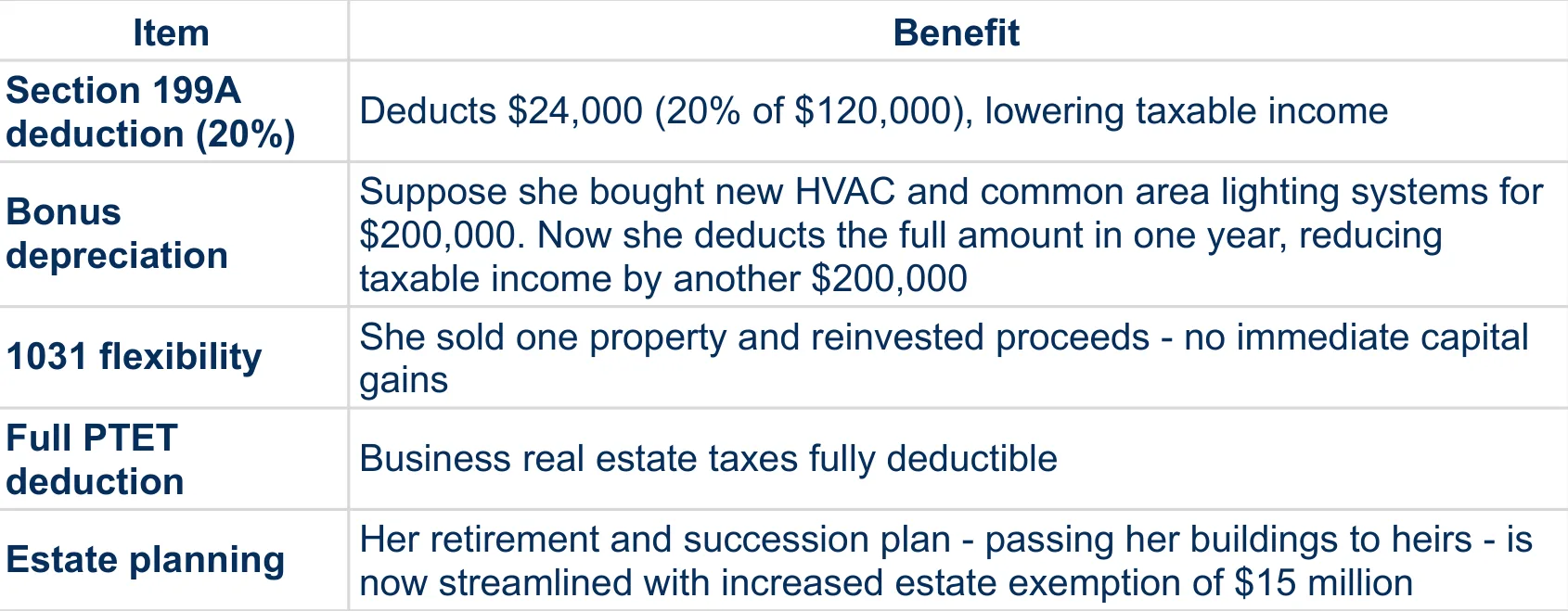

Real Estate Investor Spotlight: Meet Sarah, the Savvy Landlord

Profile: Sarah owns and manages a small rental portfolio—three multifamily buildings. Last year, she earned $120,000 net rental income after expenses. Sarah qualifies as a Real Estate Professional and uses cost segregation.

Under OBBBA, here’s how her 2025 taxes look:

Result: Sarah’s taxable income not only drops well below her gross rental income, but she also retains the flexibility to reinvest via 1031 and plan generational transfer using enhanced exemptions.

Why Investors Should Act Now – and Thoughtfully

- Permanency Breeds Confidence: Unlike prior sunsets, OBBBA’s permanence in key deductions empowers long-term planning and pro forma modeling.

- Timing Matters: For Opportunity Zone investors, there’s a transition—2026 is a cutoff year for current OZ rules. Starting in 2027, the new basis step-up and deferral regime applies.

- Talk to Your CPA, Tax Attorney, or Advisor: Proper structure, election timing, and documentation will maximize your benefit.

In Summary

The One Big Beautiful Bill is a win for real estate investors.

Integrating these into your investment strategy can yield exceptional tax efficiency. This allows investors and business owners to re-deploy their savings back into the economy- bringing benefit to our local communities.

Take your tax savings and go make a difference, investors.

Your success is someone else’s miracle.

Sources

T&H Realty ServicesNar RealtorTroutman Pepper Locke – HomepageDLA Piper.

Troutman Pepper Locke – Homepage.