The insanity has officially ended.

In the housing market that is.

While in some parts of the US, the housing market has tanked hard, locally in the Northeast, it has remained fairly steady.

The investment real estate market meanwhile, has been buoyed by the reinstatement of 100% bonus depreciation, and recent interest rate decreases with hope of more to come.

So what do you get when you have a housing market slowing, while investor growth is still very strong? You get a great time to buy Single Family Rentals. With homeownership slowing and lifestyle renting more popular, this sector’s tailwinds bode well for long-term growth.

The Stats:

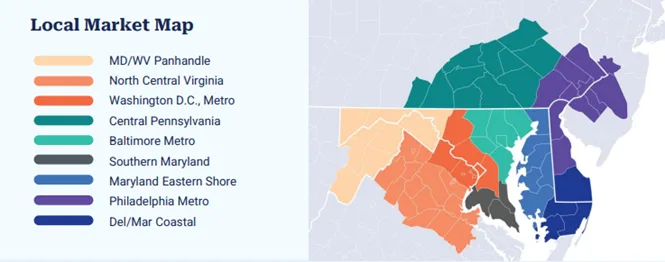

Shown below are the home sale stats from the greater Mid-Atlantic region. While prices have remained up year-over-year, it has just barely stayed positive in regions like Washington DC metro.

Add in the growing popularity of Single Family Rentals (SFRs) in the institutional arena, and investors can find opportunity to purchase and stabilize single family rentals, then bundle and sell them as portfolios.

Benefits of this Strategy:

1. Portfolio Sales Generate Premiums

Selling a portfolio of homes rather than individual assets often results in a pricing premium of 5–20%, depending on the size, location, and performance of the portfolio. Here’s why:

- Institutional Demand: Large-scale investors want immediate cash flow and diversification across markets. A portfolio offers them scale from day one, saving months or years of acquisition time and transaction costs.

- Operational Efficiency: Since Single Family rentals can easily have utility costs passed to the tenant, and have much lower turnover (Average 15% vs apartment turnover at 40-50% on average), SFR owners benefit from a lower expense margin.

- Income Stability: Investors buying portfolios value consistent rent rolls, lower vacancy risk, and established management systems. The stability of income streams with reduced expense increase risk adds to the value.

By positioning the sale as a performing asset—rather than individual properties—the seller captures the investment value, not just the real estate value.

2. Financing Efficiency

As investors grow in the SFR space, many run into financing challenges. Putting loans on one-by-one can be a time challenge, and if securing conventional Fannie Mae and Freddie Mac loans, are limited to no more than 10 in their name.

- On the institutional side, Fannie Mae and Freddie Mac, as well as some life companies and finance companies, will fund permanent financing for build-to-rent, but not SFR. Fannie and Freddie are both adamant that they will only lend on build-to-rent communities and will not fund SFR portfolios that are scattered site single-family rentals.

- Build to Rent are entire developments specifically built to rent from the ground up, which is different from Single Family Rentals, which are scattered locations.

- This has led to non-institutional lenders filling the gap for SFR. The great thing about the independent lenders, is that they can establish their own terms.

- Competitive terms common:

-1.0 DSCR

-30 Year Amortizations

-Fixed rate terms

-Competitive interest rates

-80% LTV

Since SFR has grown in understanding as a legitimate asset class, the competition in the lender space has accelerated, which has made for competitive terms for the SFR buyer.

- These terms often surpass traditional lending on large apartment complexes, which can result in SFR having stronger cash on cash returns than traditional apartments.

3. Tax Efficiency

- 1031 Exchange BUYERS:

A portfolio sale opens opportunities for the incoming buyer, to purchase with a 1031 exchange. Since many exchange buyers are looking in higher price ranges, often SFRs will not be considered, but if bundled as a portfolio sale, it opens up options to 1031 Exchange buyers. While in an exchange, you can purchase many individual properties of equal or greater value, most investors will not want to go through the complexity of finding and closing on multiple houses and dealing with just as many different sellers and deals. Simplicity is key here.

- 1031 Exchange SELLERS:

For the seller, this also provides a great opportunity to 1031 exchange as well. Usually when selling SFRs one by one, the seller would lose the ability to do an exchange with much smaller prices. When bundled as a large portfolio, it instead provides the seller an opportunity to exchange efficiently into a much larger investment.

- 721 Exchange (UPREIT):

Bundling as a portfolio and contributing properties into a real estate investment trust in exchange for operating partnership units is a strategy that is ideal for investors seeking passive income and diversification. Since SFRs are a growing asset classes, as an exit strategy, a seller could also contribute to a REIT and enjoy the tax deferment.

4. Valuation Methods for Portfolios

Traditional appraisals often undervalue rental portfolios because they assess each property individually. Portfolio buyers, however, evaluate based on income performance rather than the sales Comparison Approach.

Common valuation metrics include:

- Cap Rate Analysis: The net operating income (NOI) divided by portfolio price—typically priced more aggressively than single-unit sales.

- Stabilized Yield: Institutional buyers project performance under professional management to determine pricing, as management is often piecemeal before being sold.

- Scattered Site vs. Clustered Assets: Portfolios concentrated within one metro area often command stronger pricing due to operational efficiencies.

An experienced commercial real estate broker familiar with the SFR sector can access buyer networks beyond local retail channels, often using private investor lists to reach qualified portfolio buyers.

High-quality marketing packages not only attract institutional interest but also provide buyers confidence this package has been well managed, and will continue to provide consistent cash flow—leading to premium pricing.

By marketing to buyers who value the income stream rather than the physical homes alone, sellers often achieve stronger results.

Final Thoughts

For investors who have accumulated a portfolio of single-family rentals, selling as a package can be one of the most lucrative exit strategies available. By showcasing the properties as an income-producing business, tightening up operations, and targeting the right class of buyers, sellers can capture both real estate appreciation and operational value.

Many clients we work with invest in varied asset classes, and appreciate the experience we bring to help them maximize their investments. If you are looking to grow your investment portfolio with SFR or apartments, please reach out to us to discuss your criteria.

Video

Sources

– https://selling-guide.fanniemae.com/sel/b2-2-03/multiple-financed-properties-same-borrower

– https://lendingone.com/loan-types/sfr-portfolio-loans/

– https://arbor.com/blog/sfr-investing-a-guide-to-seizing-the-sectors-momentum/

– https://www.corevestfinance.com/single-rental-property-loan/