by Michael Kushner, CCIM

From Reset to Rebalance

The Harrisburg industrial market spent 2025 doing something healthy and necessary. It reset.

After several years of extraordinary demand and rapid rent growth, the market shifted from momentum-driven expansion to a more disciplined phase. Higher interest rates, corporate consolidation, and normalized logistics demand slowed activity, but they did not undermine the region’s long-term fundamentals.

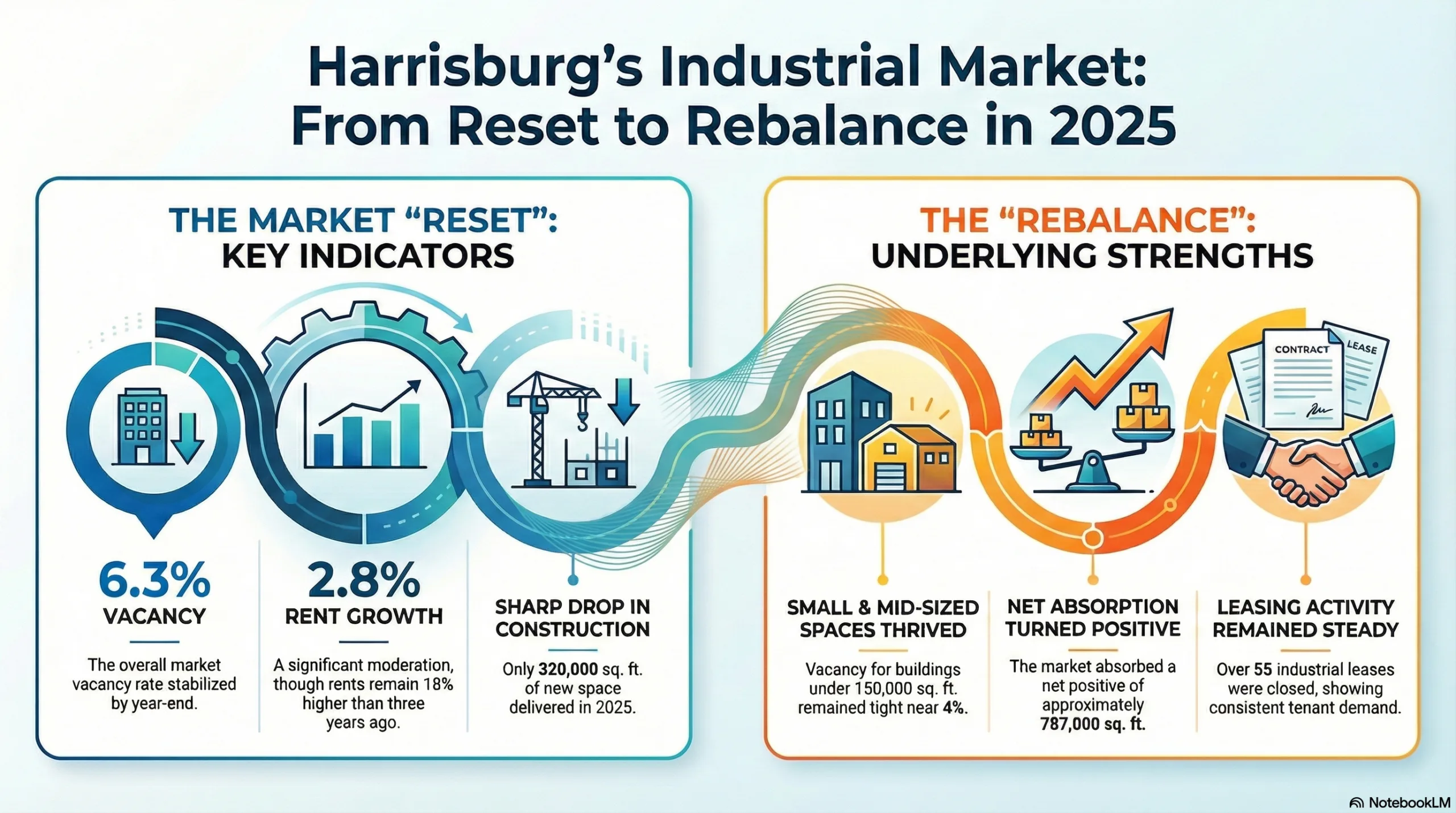

By year-end, Harrisburg’s industrial inventory totaled approximately 114.5 million square feet, with vacancy at 6.3 percent. While above pre-2022 levels, conditions stabilized meaningfully during the year. Net absorption turned positive, new construction slowed sharply, and leasing activity remained steady across much of the market.

What Changed and What Did Not

Net absorption reached approximately 787,000 square feet in 2025, a clear improvement from 2024. Much of the perceived softness came from a handful of large sublease offerings by national users adjusting their footprints, temporarily inflating availability in big-box product.

Smaller and mid-sized industrial buildings remained comparatively tight. Vacancy in functional space under 150,000 square feet stayed near 4 percent, and leasing velocity remained consistent. Demand did not disappear. It became more selective.

Leasing activity reflected this reset. More than 55 industrial leases closed during the year, with over three-quarters involving spaces under 20,000 square feet. Tenants are taking more time and negotiating more carefully, but they are still making decisions.

Rents, Construction, and Capital

Rent growth moderated as expected. Average asking rents finished the year around $8.67 per square foot, up approximately 2.8 percent year over year. While growth slowed, rents remain nearly 18 percent higher than three years ago, a reality many tenants are now encountering as leases roll.

Construction activity pulled back sharply. Only about 320,000 square feet delivered in 2025, and space under construction represents just 1.1 percent of inventory. This pause in development matters and sets the foundation for tighter conditions once demand stabilizes.

Investment activity also slowed following a surge of late-2024 institutional trades. Even so, Harrisburg continued to attract institutional capital, particularly for logistics assets. Cap rates adjusted into the 7 percent to 7.5 percent range, restoring yield spreads and creating opportunity for disciplined buyers.

Capstone Commercial Perspective

From our vantage point on the ground, 2025 felt less like a downturn and more like a return to fundamentals.

We saw tenants slow decision-making, underwrite space more carefully, and focus on operational efficiency rather than rapid expansion. At the same time, well-located, functional industrial properties, particularly small and mid-bay facilities, continued to perform. Space that was priced realistically and positioned correctly leased. Space that was not, did not.

On the ownership side, expectations began to realign. The market is no longer rewarding aggressive pricing based solely on past momentum. Today’s environment favors disciplined underwriting, thoughtful capital structures, and a long-term view of the Harrisburg region’s logistics advantages.

We remain constructive on the Harrisburg industrial market. Limited new construction, stable employment, and the region’s strategic location along major freight corridors continue to support long-term demand. As we move into 2026, preparation and local market knowledge will matter more than trying to time the cycle perfectly.

At Capstone Commercial, our focus remains straightforward. Provide clear advice, protect our clients’ downside, and position them to capitalize when opportunity presents itself.