Real estate is the world’s largest asset class, with an estimated value of $240 trillion – over three times the value of the global stock market, at $72 trillion.

However, less than 7% of the world’s real estate is currently liquid or tradeable on public exchanges.

What would happen if this changes in the next 30 years?

With a stirring inside me that the future is likely calling, I feel confident that the real estate market will be exploding in growth with the advent of Tokenization within our lifetimes.

So what is Tokenization of Real Estate?

Real Estate ownership is converted into an LLC, which is then associated with a Stable Coin value. This is then listed on a Blockchain backed marketplace, where investors can go to purchase portions of the property in token form.

Varies types of crypto currency can be used, but a Stable Coin is most desirable to peg a reliable value to the physical asset.

- There are many platforms coming to market to enable all investors, from Institutional Level down to the beginning investors a slice of the action.

Key Takeaways:

Just because real estate is tokenized, does not mean it will instantly sell.

The same principals for raising money stand: Risk & Reward.

Tokenization provides an added benefit.

Why is this good?

1. Smaller Capital Investments is much easier for the sponsor to offer. (Easy to offer a $1K investment instead of a $100K investment)

2. The tokenized asset can be traded in a secondary market, making it more liquid. Historically, the more liquid an investment is, the more secure a buyer feels. This in turn enables capital raising to take place with less friction.

3. RISK is still the most important aspect of evaluating an investment. If you can decrease the perceived risk through tokenization, to allow the investor to exit if they want, it will increase investor confidence.

4. Potential increase in value:

Because the asset can be traded in a secondary market, if it is performing well, there is a potential for the investor to sell their token shares and make a profit, or capital gain, on their asset.

This would be similar to the stock market, where investors could realize the increase in value for an operator who is performing well, without just waiting for an exit.

5. Efficiency:

For both the investor and the real estate token provider, the efficiencies of the ability to govern ownership, distribute earnings and handle investments can be increased when handled on the blockchain, along with continued security.

The Naysayers

1. There is already REITs that you can easily buy and trade to invest in real estate. How is tokenized real estate any different?

- REITs typically only offer very large properties that provide a significant economy of scale to make it worthwhile. With Tokenization, any asset anywhere can easily be offered to the public

- Publicly traded REITs are affected by the rise and fall overall of the stock markets where they are traded, making them valued halfway as a stock and halfway as real estate. A straight tokenized asset is not affected by the stock market sentiment.

2. What about Crowdfunding platforms that offer real estate opportunities?

- Like REITs, many of these assets are larger properties in order to make sense to bring them to the real estate marketplace. More options are offered on Tokenized platforms.

- Tokenization provides a currency standard to more easily facilitate trading across borders- potentially opening up more investors in other countries who want to invest in the US Real Estate market.

3. Regulation: the framework for regulatory process is still unfolding, and blending together securities with Tokenization that is still being regulated can be tough. Currently most are governed as securities under SEC rules that apply similar to other real estate fundraising.

4. Potential for tokenized real estate sponsors to commit fraud with less track record than a REIT institution or Syndication sponsor.

5. Taxes: While it may be challenging to understand the tax implications, most tokenization’s happen when the ownership is converted into an LLC, which the shares of the LLC are then sold with Stable Coin values to investors. The tax implications may still be a bit of a grey area.

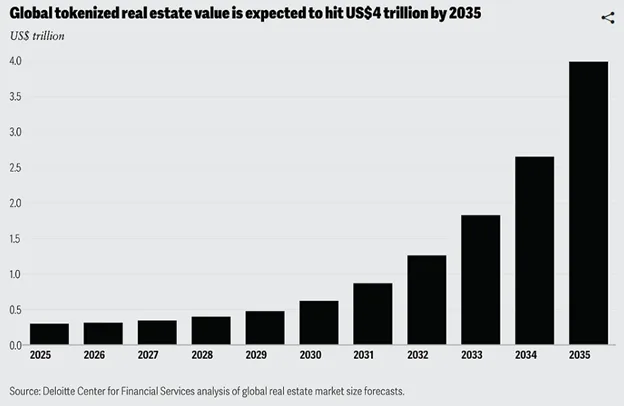

Based on the current growth and continued capabilities, the growth in Tokenized real estate is expected to hit $4 Trillion by 2035.

I am planning to be a part of it. Are you?

Conclusion

If you are looking to continue a growth trajectory, make sure your eyes are tuned to where the future is going. Those who change with the times benefit from it.

Many clients we serve have benefited from the traditional method of selling real estate. If you would like to be part of the Tokenization movement, contact us to discuss how we can help sell your property on Blockchain to recognize your future profits now.

Sources

https://digishares.io/ – Tokenization Platform for creating and trading tokenized assets

https://brickmark.net/ – Real Estate Tokenization Platform based in Switzerland

https://www.growthturbine.com/ – Capital Raising

https://castleplacement.com/ – Capital Raising Platform

https://www.rwa.io/ -Real World Asset Tokenization platform

https://vlrm.com/about – Tokenization Platform

https://redswan.io/ – Marketplace with offerings

https://dibscapital.com/home/ – Platform to list and for brokers dealers to sell equity in Businesses

-Lofty.AI Buy and sell real residential real estate https://www.lofty.ai/?utm_source=google&utm_medium=ppc&utm_campaign=18872132091&utm_content=143588130179&utm_term=fundraising%20real%20estate&gadid=634242113999&gad_source=1&gad_campaignid=18872132091&gbraid=0AAAAApAfwrDcaB1WA21JqjE_Gl1mO0WKc&gclid=Cj0KCQiAsNPKBhCqARIsACm01fRR9VL0ayHGotQP0saHywLbmec1A3wtRMsuh2louqEuKkj5lv8HhLoaAtAmEALw_wcB